7667766266

enquiry@shankarias.in

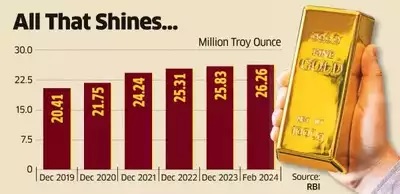

According to the World Gold Council (WGC), the demand for gold has risen by 28% this year.

Reasons for stocking up of gold by Central Banks

India owns 781 tons of gold, ranking it as the 9th largest gold-holding country in the world.

Quick facts

The World Gold Council

References