7667766266

enquiry@shankarias.in

Click here to know more on the issue

Why in news?

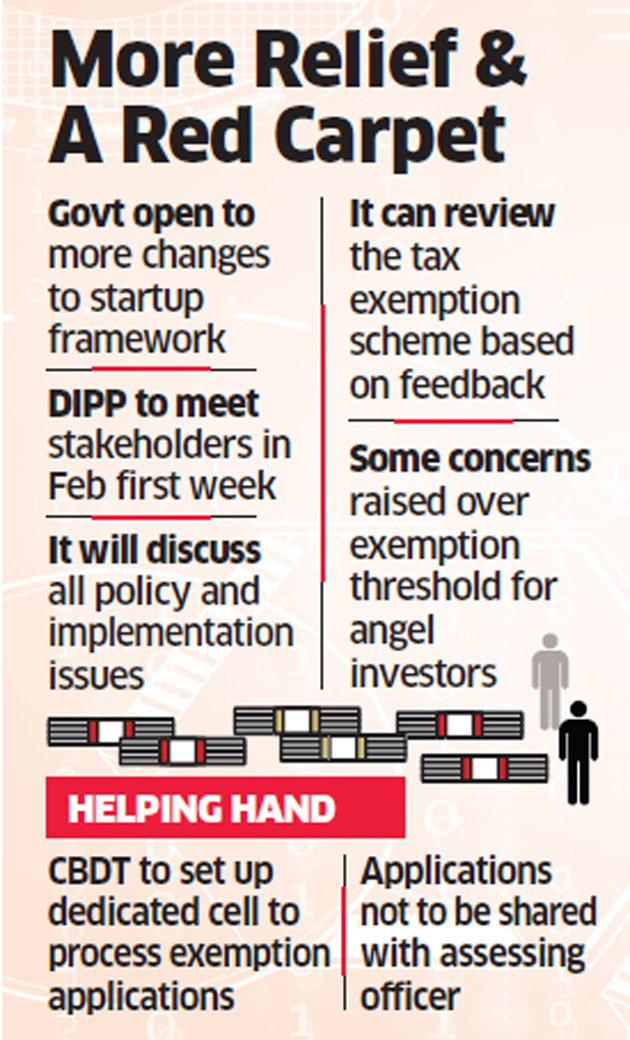

The government has released a new notification easing norms for exemption from the angel tax under Section 56 of the Income-Tax Act.

Why was there a necessity for this notification?

What does the notification say?

What are the concerns with the notification?

Source: Business Standard, The Quint