7667766266

enquiry@shankarias.in

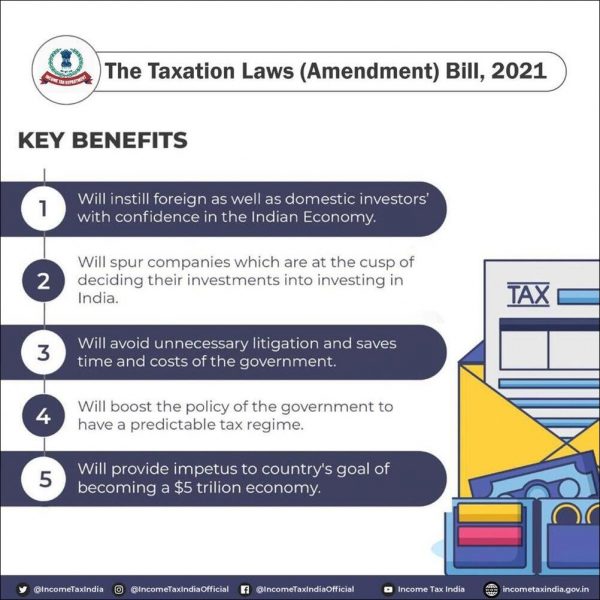

The Cairn Energy firm has said it has concluded all steps prescribed by the Indian government in order to be eligible for the refund of retroactive tax levy and is expecting to get back Rs. 7,900 crore.

PCA was established in 1899 to facilitate arbitration and other forms of dispute resolution between states. Its headquarters is in Hague, Netherlands.

Reference