7667766266

enquiry@shankarias.in

What is the issue?

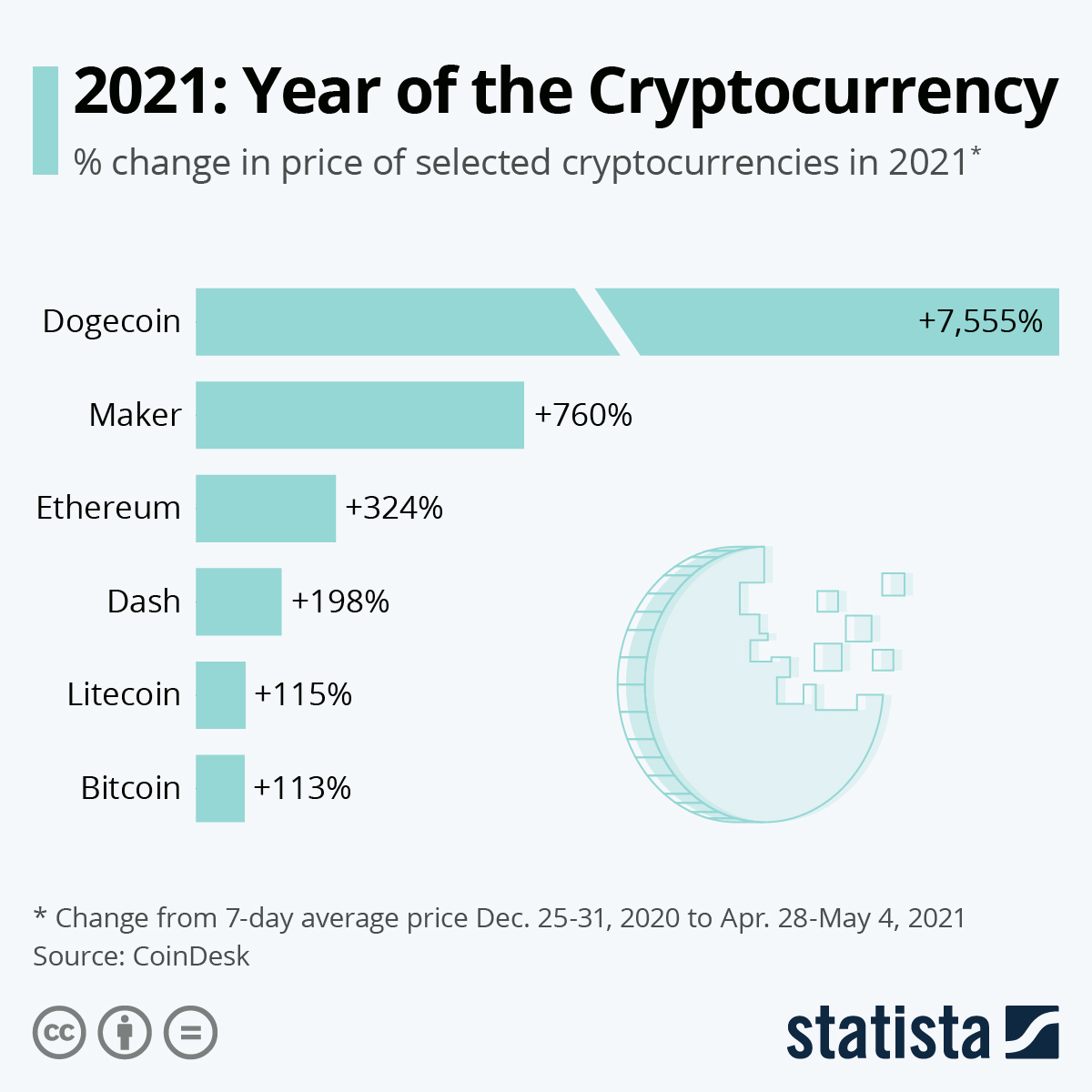

The current rally in bitcoin has witnessed the increasing participation of retail investors in India but the future of bitcoin and other cryptocurrencies is still under suspicion.

To know more about regulation of cryptoassets, click here

In a 2018 circular, the RBI had banned banks from dealing with virtual currency exchanges and individual holders.

But the Supreme Court lifted the ban in 2020 stating that the circular didn’t pass the ‘test of proportionality’

References