7667766266

enquiry@shankarias.in

Why in news?

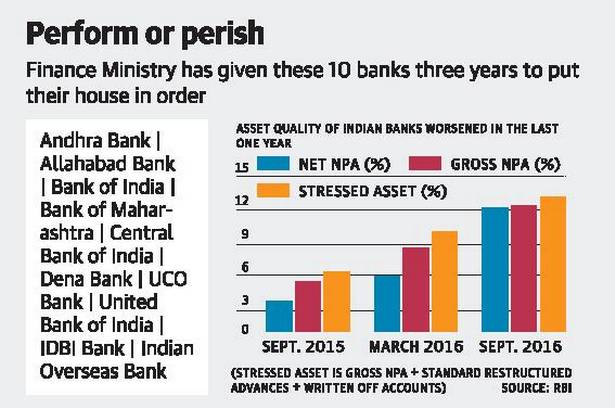

The Finance Ministry has written to 10 public sector banks, making it clear that the lenders would only get further capital infusion once they submit a time-bound turnaround plan.

What is the reason behind such a move?

What is the response from RBI?

What were the earlier measures to revamp banks?

Source: The Hindu