7667766266

enquiry@shankarias.in

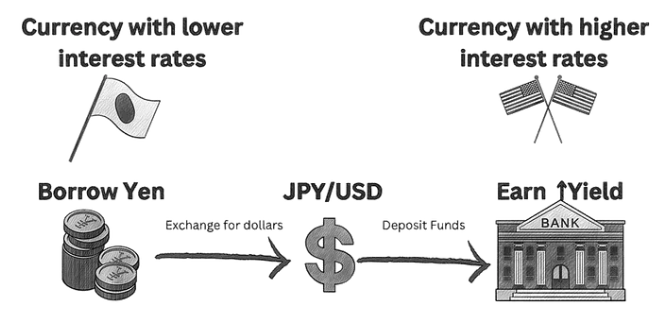

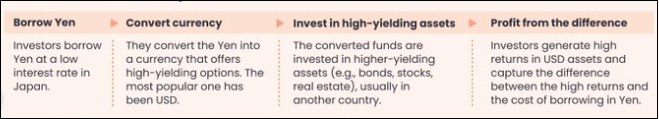

Recently, global stock markets experienced their steepest decline in decades, driven by fears of a US recession, escalating West Asian geopolitical tensions, and the unwinding of the yen carry trade.

|

Currency Trade |

|

FOREX, short for Foreign Exchange, is a marketplace where national currencies are bought and sold.

As per reports, the Japanese Yen carry trade market is estimated to be over 20 trillion USD.