7667766266

enquiry@shankarias.in

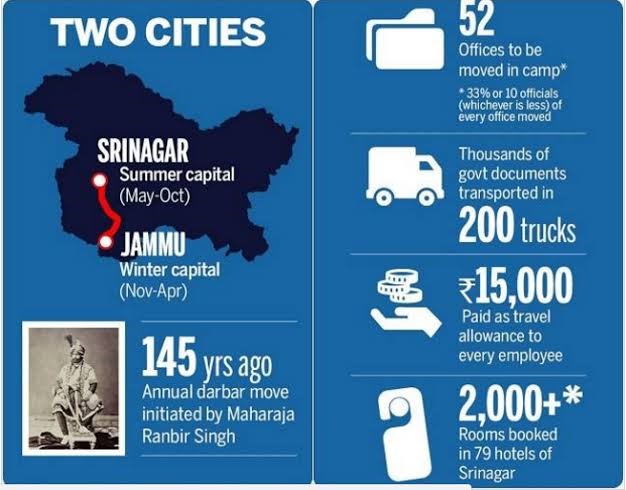

Darbar Move of J&K

Moratorium for NBFC’s

NBFC

Vande Bharat Mission

This should not be confused with Vande Bharat Express

Vande Bharat Express

African Swine Flu

Operation Samudra Setu

Source: News on Air, Hindustan Times, the Hindu