BJP MP recently called the Lok Sabha Leader of Opposition (LoP) Rahul Gandhi a “traitor of the highest order”along with OCCRP, Soros, trying to destabilise India.

Cyber Crime Wing of Tamil Nadu police warns of new UPI scam Known as the ‘Jumped Deposit’ recently.

|

National Cyber Crime Reporting Portal |

|

The Hindu | ‘Jumped Deposit’ Scam

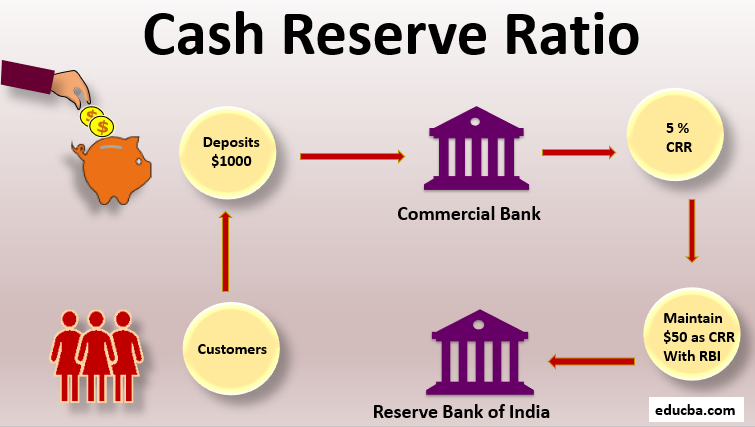

Recently, there has been an expectation that the Reserve Bank of India (RBI) may announce a reduction in the Cash Reserve Ratio (CRR) by 25 basis points (bps) or 50 bps.

|

Increase in CRR |

Decrease in CRR |

|

|

The Reserve Bank had last reduced the CRR from 4% on March 28, 2020, after keeping it unchanged at 3% for the previous 7 years. It was last changed to 4.5% on May 21, 2022.

Recently, the Akal Takht has imposed religious punishment to the former Deputy Chief Minister of Punjab, Sukhbir Singh Badal for mistakes done in his party rule from 2007 t0o 2017.