7667766266

enquiry@shankarias.in

Why in news?

It was recently announced that the U.S. would not renew exemptions for India from its sanctions for importing oil from Iran.

What was the exemption on?

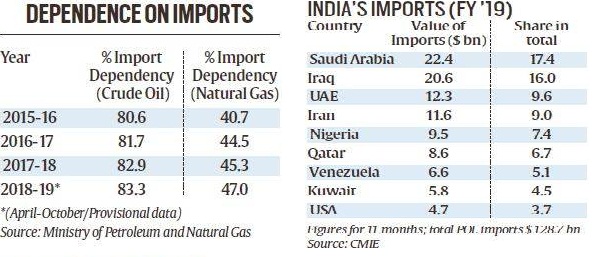

How crucial is oil import to India?

How dependent is India on Iranian oil?

What are the implications of the US's move?

The possible implications for India include the following:

How prepared is India?

What are the challenges ahead?

What is Iran's response?

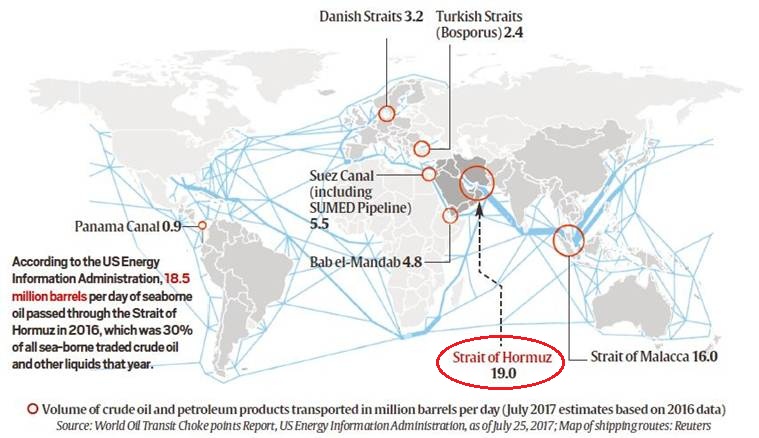

[The seven choke points in the map above are critical nodes of the world’s energy security grid.]

Source: Indian Express, The Hindu