What is the issue?

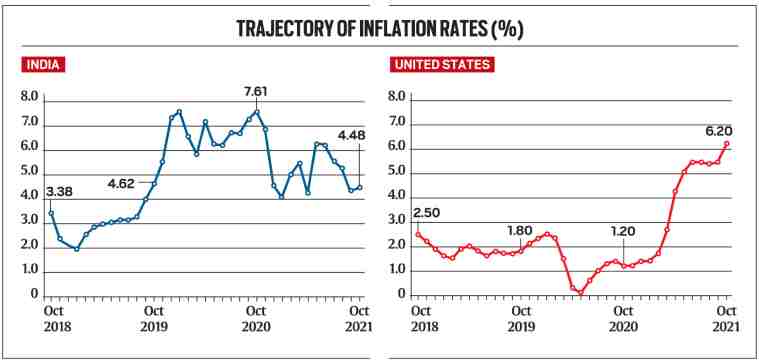

The United States’ Labor Department reported that retail inflation had spiked to 6.2 % in October whereas India’s National Statistical Office data showed that retail inflation rose to 4.5 % for the same month.

It is the rate at which prices increase over a given period.

In India, the inflation rate is calculated on a year-on-year basis.

A high inflation rate erodes the purchasing power of people.

Since the poor have less money to withstand fast-rising prices, high inflation hurts them the hardest.

Increase in demand – the unexpectedly fast recovery spurred an all-round demand from consumers.

This recovery was further fuelled by billions of dollars pumped by the government to provide relief to consumers and those who lost their jobs and to stimulate demand.

Decrease in supply - The pandemic in 2020 led to widespread lockdowns and disruptions across the world.

Companies let go of employees and sharply curtailed the production.

The supply chains of production spanning several countries and continents were bent out of shape.

Since the pace of economic recovery has been much faster than the supply chain recovery, this has worsened the mismatch between demand and supply thus triggering a sustained price rise.

The Federal Reserve, the US central bank, targets an inflation rate of 2 %.

The 6.2 % inflation rate in the the US is the largest year-on-year increase in the last three decades.

The retail inflation in the US has been rising sharply almost every passing month since May 2020.

Hence, the US inflation rate has become a massive concern for its citizens.

Core inflation is the change in the costs of goods and services but does not include those from the food and energy sectors.

This is because the food and energy prices prices can be too volatile or fluctuate wildly.

Core inflation is used to determine the impact of rising prices on consumer income.

When prices increase globally, it will lead to higher imported inflation i.e. Indians import will become costlier.

High inflation in the advanced economies, especially the US, will likely force their central banks to adopt a tight money policy which will lead to higher interest rates.

So, Indian firms trying to raise money outside India will find it costlier.

Also, RBI will have to align its monetary policy at home by raising interest rates domestically.

Reference