7667766266

enquiry@shankarias.in

Why in news?

Over the last few months, as most economies have started to recover, inflation has emerged as an important challenge.

What is the issue?

Inflation is the rate of increase in prices over a given period of time.

Stagflation describes a situation of stagnant economic growth, along with persistently high inflation.

What is the situation in India?

The headline inflation measure demonstrates overall inflation in the economy. It is more volatile compared to core inflation.

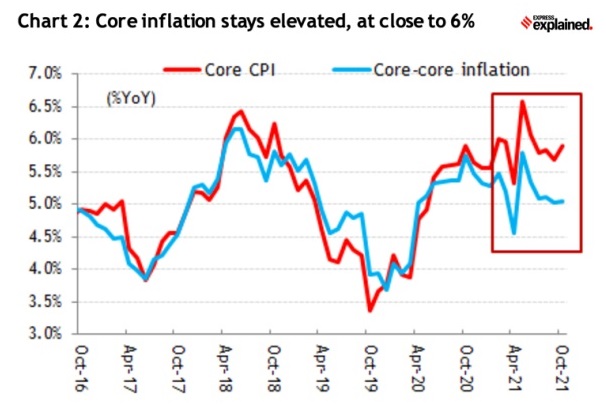

Core inflation is the change in the costs of goods and services but does not include those from the food and energy sectors.

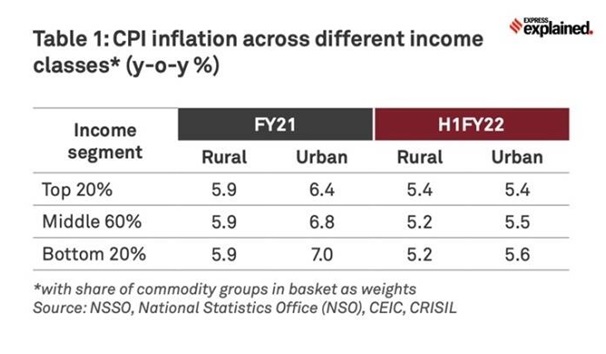

Who has been worst affected by high inflation of late?

Reference