7667766266

enquiry@shankarias.in

What is the issue?

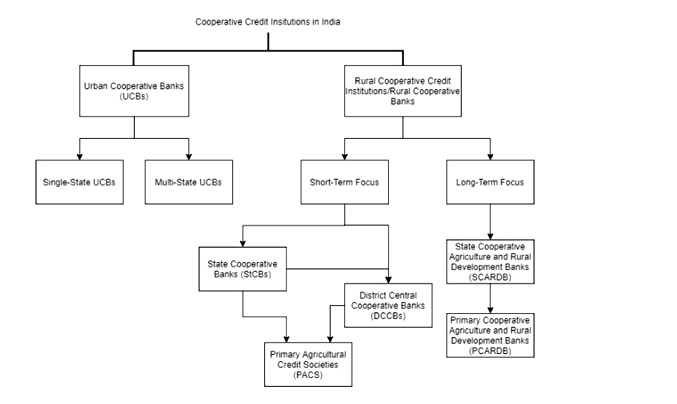

Since most of the co-operative credit societies avoid regulatory oversight and indulge in risky lending, their supervision needs to be tightened.

Reference