7667766266

enquiry@shankarias.in

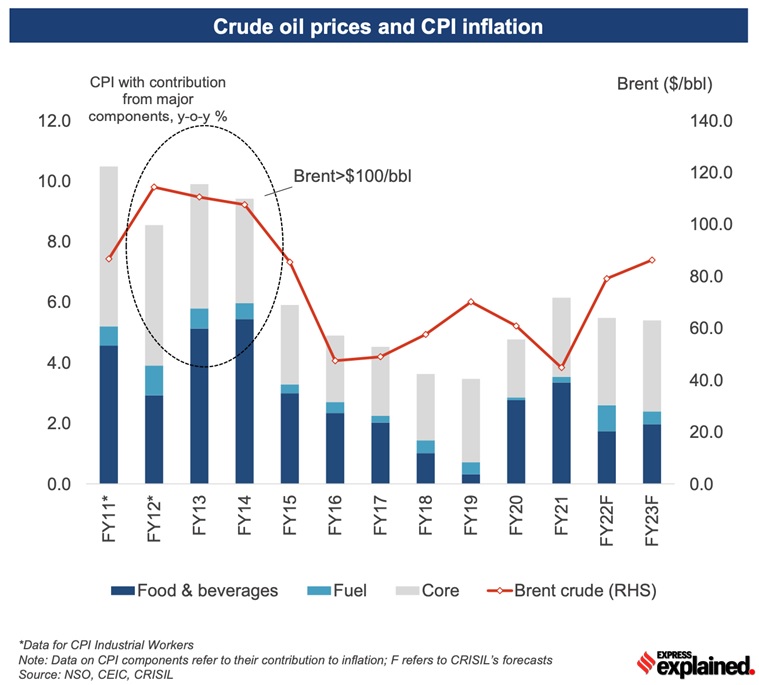

Retail inflation in February reached an eight-month high and breached the RBI's comfort zone even without the domestic oil prices reflecting the higher crude oil prices.

Reference